Electric cars will treble market share this year as most carmakers on track to meet EU emissions targets - analysis

Also available in French, German, Italian, Polish and Spanish

- EU standards are driving electric cars towards 10% of sales, and 15% in 2021

- But lax targets for 2025 and 2030 would see EV sales stagnate for a decade

- BMW, PSA, Volvo and FCA-Tesla pool already compliant with 2020 target as of H1

Electric cars will treble their market share in Europe this year as a result of EU car CO2 targets, new analysis shows. Despite the pandemic, EV sales have surged since 1 January, just as the emissions standards kicked in, and will reach 10% this year and 15% in 2021. Transport & Environment (T&E), which analysed sales in the first half of 2020 as well as carmakers’ compliance strategies, said it shows ambitious CO2 standards work but there's a risk EV momentum runs out of steam after 2021 due to lax EU targets for 2025 and 2030.

Julia Poliscanova, senior director for clean vehicles at T&E, said: “Electric car sales are booming thanks to EU emissions standards. Next year, one in every seven cars sold in Europe will be a plug-in. EU manufacturers are back in the EV race, but without more ambitious CO2 targets in 2025 and 2030 to spur them on, they'll run out of steam as soon as 2022.”

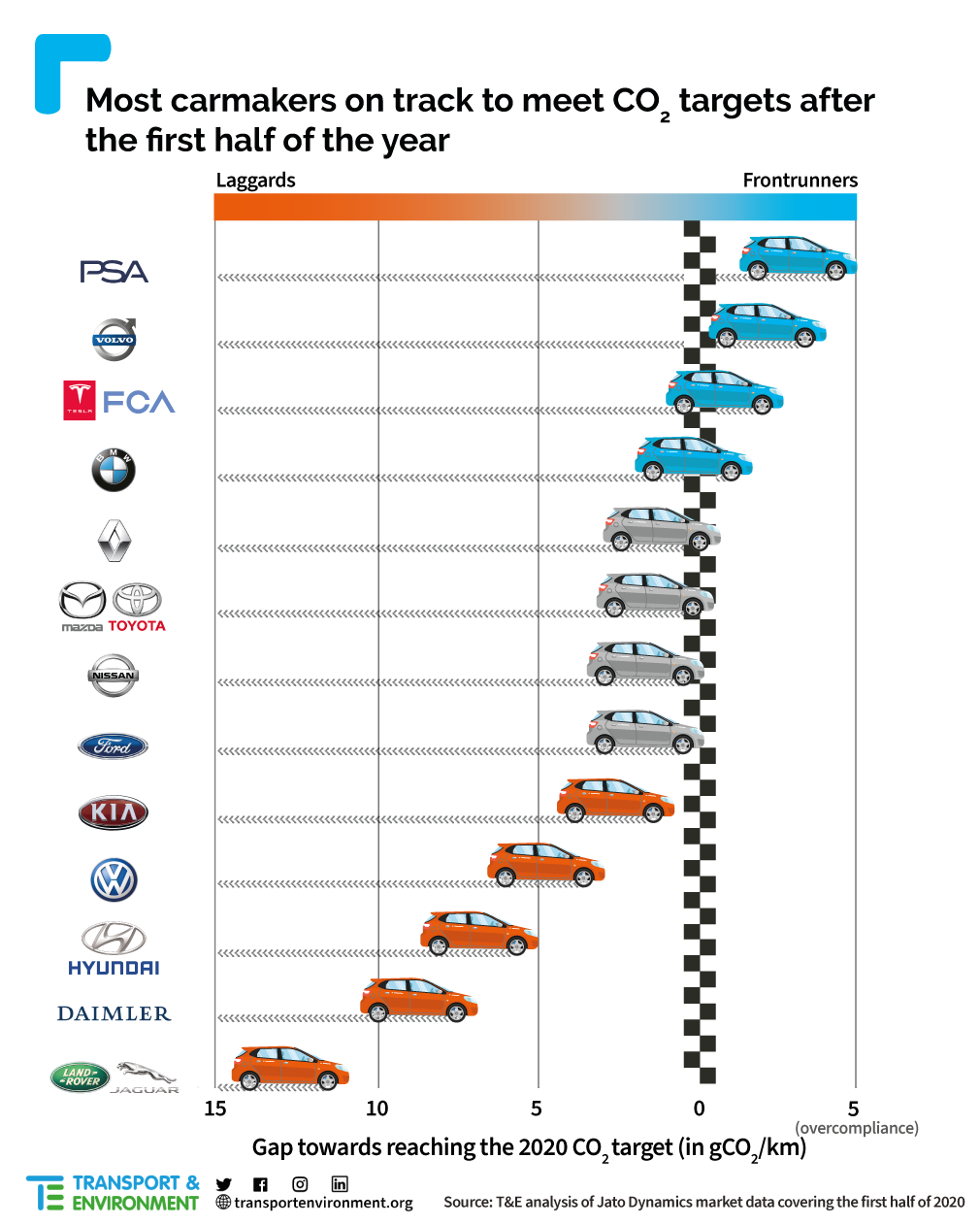

PSA Group, Volvo, FCA-Tesla and BMW Group are already complying with the EU’s target for average emissions of new cars, based on their sales in the first half of 2020, T&E’s analysis shows. Renault, Nissan, the Toyota-Mazda pool and Ford have a small gap to close of 2 grams of CO2 per km. The sales of the Zoe alone in 2020 will knock off 15g of CO2 to help ensure Renault complies.

While further away, the Volkswagen Group (5g), Hyundai-Kia (7g-3g), Daimler (9g) and Jaguar-Land Rover (13g) should cross the line either through their compliance strategies of selling more plug-in vehicles, by pooling emissions with other companies, or both. Daimler is expected to close much of the gap by selling more of its plug-in hybrids, including the E-Class, C-Class, A-Class and GLC – sales of which have grown rapidly this year.

But while electric cars’ market share will go from 3% to 10% this year, and to 15% next year, we may expect to see it at only 20% four years later if the current CO2 regulation is not revised, the analysis shows. Norway shows how fast the EV market can grow: from 6% of sales in 2013 to almost 50% five years later, in 2018.

Worryingly, sales of lucrative but highly-polluting SUVs crept up to 39% in the first half of 2020. This is encouraged by a loophole in the EU regulation whereby selling heavy vehicles actually gives carmakers laxer CO2 targets. Also, half of all the electric cars sold today are “fake electric” plug-in hybrids that are rarely charged and emit 2-4 times more CO2 in the real world than the lab tests show.[1] T&E said the EU needed to set 2035, at the latest, as the end date for sales of combustion engines - including current PHEV technology.

Julia Poliscanova concluded: “The electric car is finally entering the mainstream in Europe but SUV sales are still growing like weeds. The only way to kill off highly-polluting vehicles is to give carmakers a clear end date now. Cars that run on biofuels, fake electric engines or fossil gas emit CO2 and shouldn’t be allowed on the market after 2035.”

Notes to editor:

[1] See: The ICCT, Real-world usage of plug-in hybrid electric vehicles: Fuel consumption, electric driving, and CO2 emissions, (2020).

https://theicct.org/publications/phev-real-world-usage-sept2020

Also: T&E, UK briefing: The plug-in hybrid con, (2020).

https://www.transportenvironment.org/publications/uk-briefing-plug-hybrid-con

Read more:

Report: Mission (almost) accomplished - Carmakers' race to meet the 2020/21 CO2 targets, and the EU electric cars market